HOA Reserve Study Services

Strategic Financial Planning for Homeowners Associations

Our HOA Reserve Study services provide comprehensive financial insights, crucial for maintaining the health and sustainability of your community. By identifying current and future financial requirements, we ensure your HOA can manage its funds effectively, preventing financial shortfalls and enhancing community value.

Comprehensive Components of Our HOA Reserve Studies

Executive Summary

Reserve Expenditures Table

Reserve Funding Plan

Asset-Specific Insights

Maintenance Strategy

Visual Financial Tools

Trusted by LEADING HOAs

We are proud to be the preferred reserve study partner for numerous HOAs across the region. Our tailored approach and dependable service have made us a trusted advisor in HOA financial planning. Here’s a look at some of our esteemed partners:

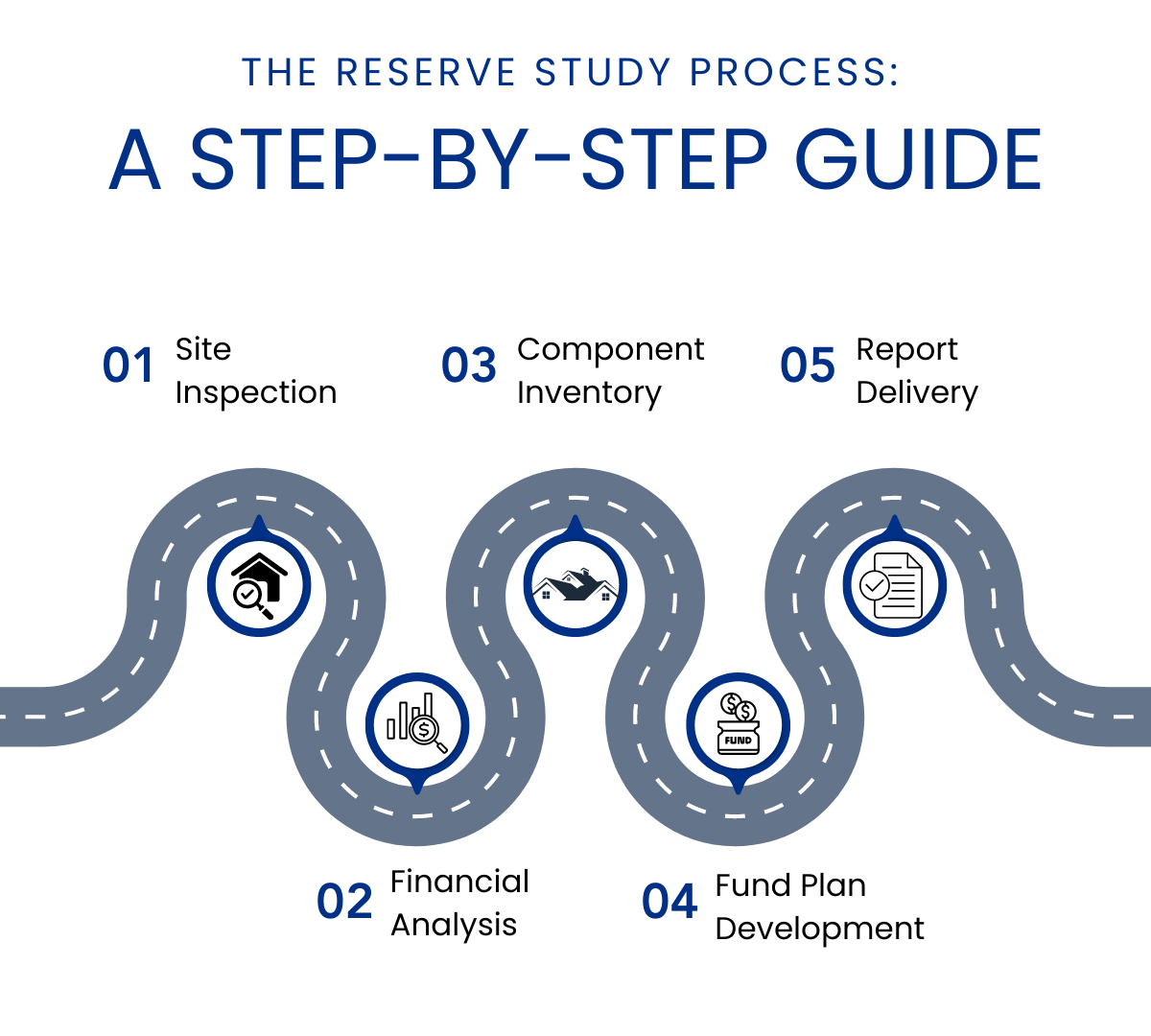

Our HOA Detailed Reserve Study Process

Step 1: Site Inspection

Our experts conduct a thorough on-site inspection to assess the current condition of all physical assets. This foundational step ensures accurate data collection for future planning.

Step 2: Financial Analysis

We compile and analyze financial documents to understand past expenditures and forecast future needs. This includes reviewing fund statuses and estimating upcoming costs.

Step 3: Component Inventory

We create a detailed list of major components, noting their life expectancy and repair/replacement costs. This inventory is crucial for precise capital planning.

Step 4: Funding Plan Development

Based on the component inventory and financial analysis, we develop a customized funding plan that targets sustainability and minimizes assessment risks.

Step 5: Report Delivery

We deliver a comprehensive reserve study report that includes all findings, analyses, and recommendations. This report is designed to facilitate informed decision-making for property management.

Benefits of Our HOA Reserve Study

Enhanced Financial Preparedness

Prepare for future expenses with a clear understanding of your financial needs.

Reduced Risk of Unexpected Costs

Proactively manage potential repairs and replacements to avoid emergency expenditures.

Informed Strategic Decision-Making

Leverage detailed financial data and projections to make well-informed decisions that benefit your community.

FAQ: Have questions?

An HOA Reserve Study is a comprehensive evaluation of a homeowners association’s major components and financial health. It assesses the current condition of communal property, estimates the remaining lifespan of major systems and components, and forecasts the costs associated with repairing or replacing them. This study ensures that sufficient funds are reserved for future capital expenses, reducing financial surprises.

Reserve Studies are crucial for maintaining the financial health of an HOA. They help prevent the risk of special assessments by ensuring that funds are available for major repairs or replacements. A well-conducted reserve study also supports transparent budgeting and builds homeowner trust by demonstrating prudent financial planning.

It is recommended that HOAs conduct a full reserve study every three to five years or whenever significant changes to the property or its management occur. However, yearly updates are advised to reflect the most accurate financial and physical status of the association.

Yes, by accurately forecasting future expenses and creating a funding plan, a reserve study helps your HOA avoid financial shortfalls. This proactive approach allows for steady funding and reduces the likelihood of needing to impose large special assessments unexpectedly.

Our service includes a detailed site inspection, financial analysis, and a comprehensive report that provides a 30-year projection of your community’s capital needs. We also offer tailored recommendations for funding your reserves and strategies for maintaining and extending the life of your property’s components.

We customize each study based on your unique property features, financial circumstances, and community expectations. Our team considers all relevant factors, including your current reserve fund status, recent expenditures, and planned future projects, to ensure the study is as applicable and beneficial as possible.

More From Our Blog

HOA Reserve Studies: A Must-Have Financial Tool

Uncover why HOA reserve studies are crucial for maintaining community assets and ensuring long-term financial stability. Learn to plan effectively with our comprehensive, detailed guide.

Step-by-Step Guide to HOA Reserve Studies

Unlock the essentials of HOA reserve studies with our step-by-step guide. Learn how to conduct thorough physical and financial analyses to ensure your association’s long-term stability.

Assessing Your HOA’s Reserves: Is It Enough?

Explore essential strategies for managing HOA reserves to ensure your community’s financial health and long-term property maintenance, fostering a sustainable and secure future for all residents.